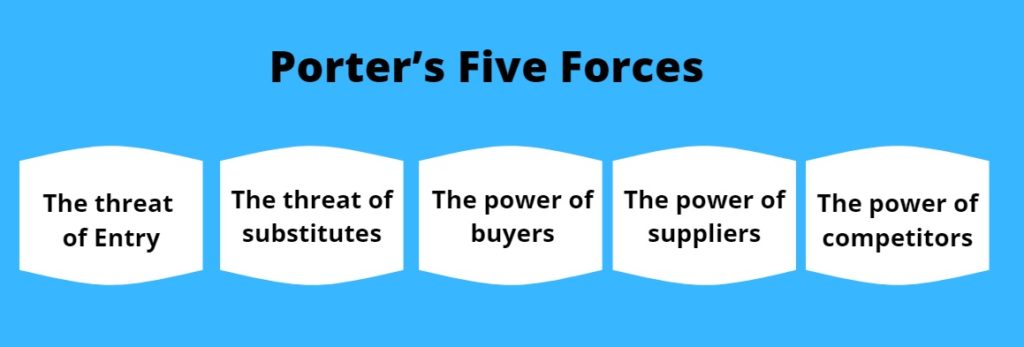

Porter’s five forces framework was introduced by Michael E. Porter in 1979. This is a common tool used in analyzing business competition. This helps to identify five main forces that shape the competition n every industry and helps to discover the industry’s strengths and weaknesses. Porter’s five forces framework is a main tool used by any business when making their strategic decisions and to determine corporate strategies.

The threat of Entry

This is the first force in Porter’s five forces framework which measures the easiness of a new competitor to enter the market. The attractive business industry has a higher threat of entry. It creates a competition between the existing competitors in the industry and discourages new entry. In a business industry that has a higher threat of entry, the below barriers can be seen often for the new entrants to overcome.

- Scale and experience – For some industries, the scale of production and the experience they have in the field is very important. Some products are popular due to the larger scale of production and distribution. The scale helps to compete with the larger scale competitors. Experience helps to produce cost-effective products. A new entrant needs to reduce its cost of production and compete with existing competitors.

- Access to supply and distribution channels – In many industries, the manufacturer has ownership of the supply methods. Or the supplying method is dominated by a long term manufacturer in the industry. The new entrant should have the capability to find a supplier who can provide them the material for the production process. Apart from that, the distribution channels are also dominated by a few large scale producers in this market. The new entrant has few opportunities to distribute its products to the consumers.

- Legal barriers – Legal barriers in entering a new market can vary from patent rights to government regulation to the markets. If there is such regulation legal barrier in the market, new entrants cannot enter the market easily. In a situation like this, differentiation can help the new entrant to access the industry.

The threat of substitutes

Substitutes are products or services which provide a similar type of benefit as the existing product but created through a different process of production. Substitutes can create a huge impact on the product as it gives an alternative option to the consumers. If the threat of substitutes is high in n industry, the profits can be low. The threat of substitution puts a cap on the product price to minimize the possibility of consumer switch to substitutes.

- Price/performance concept – Even though the price of the product is high, if the performance of the product is higher, then the substitute power is high. In some product types, the advantages are more effective than the prices.

- Extra-industry effects – The substitutes of the industry can be used as an eye-opener for the existing products to identify the possible threats and act to minimize the damage that can happen in the future.

The power of buyers

Buyers are the immediate customers of the production. They might not be the end consumers of the product, yet powerful buyers can demand cheaper prices. If the power of the buyers is high in the industry, the profits can be less. Buyer power can be considered as high in the below situations.

- Concentrated buyers – When a few large scale buyers are accountable for the majority of the sales in the company, the buyers have the power to demand a price reduction.

- Low Switching costs – If the switching cost is low, the buyers can easily switch to substitutes for production. This gives more power to the buyers to demand as they have a strong negotiation capability.

The power of suppliers

Suppliers are the providers of the raw material for the organization to produce their product or service. If the supplier power is high in an industry, they can demand high prices. It is disadvantageous for the company as the supplier can switch to another product if they d not agree with the supplier’s conditions. The power of the suppliers is high in the situations mentioned below.

- Concentrated suppliers – If a few large scale suppliers are dominating the supply in the market, suppliers have more power over the buyers.

- High switching cost for the producers – If the switching from one supplier to another is costly, the suppliers have more power to demand as they know the customer has to purchase from them agreeing to their demands.

The power of competitors

Competitors are the organization who produces a similar type of product or services and who aims the same customer segment. Competitor rivals are different from substitutes as they provide the same products to the same customer category. If there are many competitor rivals in the industry, the customer has a variety of choices and the possibility of creating profits is low. Few factors affect the size of the competitor rivalry in any industry.

- Competitor Balance – If the competitors are similar in size and similar in the production, the power of competition divides between all equally.

- High Fixed costs – In certain industries, companies have to bear the high fixed cost in the production process. They have to make price changes to cover the fixed cost. This can be difficult in industries with high competitor revelry as the competitors gain more advantages due to the price changes in the product.

Mentioned above are the key elements of Porter’s five forces framework. This can be considered as the main learning for any organization that is operating intending to maximize profits. Porter’s five forces framework helps an organization to position its product in the correct market and to develop effective strategic decisions.

Related Articles

SWOT analysis : 4 aspects