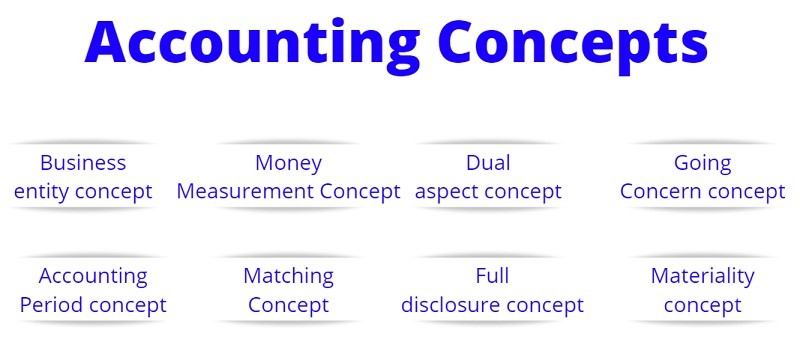

Accounting is a broad field which helps almost all the organizations in the world to maintain their finance. Several Accounting concepts have been introduced to the subject to make sure the accounting done by all the organizations and individuals are following the same procedure and techniques. In this article, let’s have a closer look at the main accounting concepts that can be seen in the field of accounting.

01. Business entity concept

This is one of the main accounting concepts explains that the business is recognized as a separate person when accounting for the business. This will help to separately identify the business transactions and the owner’s transactions as it is important to calculate the organization’s profit or loss accurately. It is a necessity that all organizations should follow this concept when accounting for the business and account separately for the money brought in to the business or brought out from the business for its owner.

02. Money Measurement Concept

This concept explains that only the transactions that have a monetary value will be accounted for when recording the transactions. Any other transactions which cannot be measured in monetary terms, no matter how important, will not be recorded in books of accounting. As an example, if the organization has implemented a major change in the management structure, it will not be recorded in the books of accounting as there is no financial value to that.

03. Dual aspect concept

This accounting concept explains that for every transaction recorded in the books of accounting, there should be two entries recorded. This is considered the golden rule of accounting where the entire accounting system is based on the dual aspect of the double-entry concept. This explains that for every credit entry, there should be a debit entry that tallies to the credit entry.

04. Going Concern concept

This concept assumes that the business will continue to operate and will not stop the business activities in the foreseeable future. Due to this reason, the financial statements for a particular financial period are created as a part of a series and carry the balances to the next financial period. This assumes that the non-current assets of the organization will not be sold any time soon and it will meet its obligations.

05. Accounting Period concept

Accounting period concepts explain that every organization should select a specific time period to complete their accounting cycle. Generally, the period of the accounting cycle is considered as one year but based on the organizational requirements, they can select an accounting cycle suitable for the organization. This concept helps to divide the life of the organization into smaller segments and to provide timely and accurate information to the organization stakeholders.

06. Matching Concept

This concept explains that the revenue and the expenses of an organization should be included in the particular accounting period. The income should be recorded even though it is received or not and the expenses should be recorded even though it is paid or not. Using this method, the actual profit for the accounting period can be calculated accurately.

07. Full disclosure concept

This concept states that all the relevant information should be disclosed in the financial statements. The stakeholders are using the financial reports to make decisions about the organizations and the details provided should be accurate and they should fully disclose the financial status of the organization.

08. Materiality concept

This accounting concept states that all the material facts should be included in the accounting process. Immaterial and insignificant facts can be left out. The materiality of any transaction depends on the nature of the business, the value of the transaction and the value it has for the stakeholders.

Accounting concepts help organizations to maintain financial reports in a common order. It helps the stakeholders to compare the financial reports and make important organizational decisions.