Opportunity Cost is an important concept in computing the true cost of resource allocation either in consumption in production. The concept of opportunity cost is used by the economists’ true cost of resource utilization. In economic analysis, two types of cost are considered.

- Financial cost – this is the cost incurred in the form of the payment for factors of production (rent, interest, wages/salaries, profit) which is considered for accounting purposes as cost of production.

- Opportunity cost – this is the cost concerned by the economists in the form of the benefit of the lost opportunity due to allocation of resources in one of the alternative uses.

The opportunity cost of allocating resources is generated due to the following characteristics of the resources.

- Resources are comparatively limited in supply or the resources are scarce.

- The resources are having alternative uses.

If the resources are available in unlimited quantities there is no need to forgo any of the alternative use when increasing output. In the same way, if the resource has one and only use, the issue of opportunity cost does not arise. Therefore the concept of opportunity cost can be explained based on the above characteristics only.

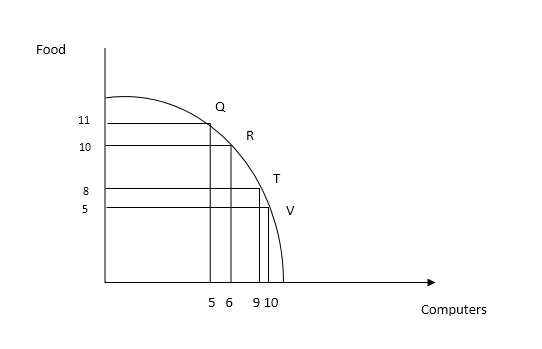

As per the above diagram, the economy is in full employment, and all the resources are used to produce two alternative products, namely food, and computers, the output is determined on the production possibility frontier. If the economy needs to increase the production of computers by one unit, from 5 to 6, the opportunity cost involved is one unit of food. At the same time, if the production of computers is to increase from 9th unit to 10th, three units of food have to be forgone. As the production of computers increases, the opportunity cost increases. The reason is that more resources are removed from food production to increase the production of computers, the economy is lacking a sufficient amount of food. By looking at the nature of opportunity cost, the decision-makers identify the most desirable combination of output and allocate the resources more efficiently.

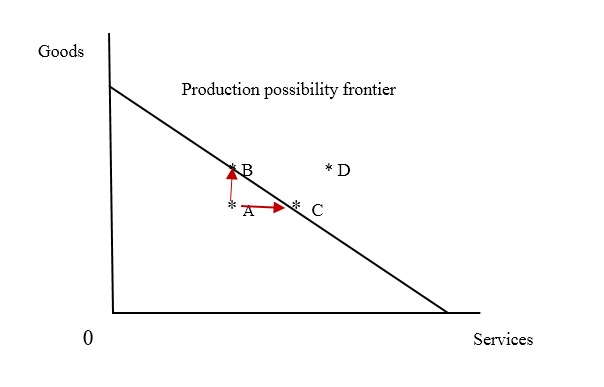

There are some limitations to the above explanation. If the economy is not in full employment, the output of one product or both can be increased without an opportunity cost as shown by the following diagram.

If the output is determined at the point “A” within the area covered by the production possibility frontier, unutilized resources are still available in the economy. If the economy needs to increase the production of goods from the point “A” to “B” or service production from the point “A” to “C” it does not involve any sacrifice or opportunity cost because available unemployed resources can be made use of for that purpose. But the point “D” located beyond the production possibility frontier is unachievable because the economy does not possess sufficient resources.

Opportunity cost analysis also plays a crucial role in determining a business’s capital structure. A firm incurs an expense in issuing both debt and equity capital to compensate leaders and stakeholders for the risk of investment, yet each also carries an opportunity cost. Funds used to make payments on loans cannot be invested in stocks or bonds which offer the potential for investment income. A firm tries to weigh the costs and benefits of issuing debt and stock, including both monetary and non-monetary considerations, in order to arrive at an optimal balance that minimizes opportunity cost.

In addition, the international specialization of modern economies is based on the opportunity cost concept. The benefit of international trade depends on the comparative advantage that a country can gain. The product to be specialized is determined by considering the opportunity cost. The countries specialize in the product that they can produce with minimum opportunity cost. Then only the expected benefits of international trade are possible.

We can conclude the concept of opportunity cost is so vital in an efficient allocation of resources in economies.