Savings

Saving is the most important factor that determines the level of economic growth of a country.

As the success of an individual depends on his or her level of saving, the living standard of a

nation depends on the level of national savings since it is a contributory factor of a number of

microeconomic indicators such as the GDP. National income. Aggregate demand and supply,

General Price Level, etc.

Generally, individual saving is the part of disposable income that is not consumed at present. Disposable income is the income after paying tax to the government.

Hence, disposable income Yd = Y – t. Two ways of spending disposable income can be

identified. Part of it is used for consumption and the remaining will be saved for future use. It

can be shown as a formula to read as Yd = C + S.

National saving is the sum of private saving and Public savings. Public saving is the part of

the government’s income after spending re-current expenditure in a financial year. This is shown in

the government’s budget and it will be posted to the capital account or invested in capital.

The size of national savings is a vital factor that has multiple effects on economic performance.

Individuals deposit their remaining incomes in commercial banks. There are different factors that

motivate savings in an economy.

i. Transaction motive – Saving for future transactions

ii. Precautionary motive – Saving to use in future difficult situations

iii. Speculative motive – Saving with the intention of investing

iv. Rete of interest

v. Availability of saving facilities and general attitude of the people of saving.

vi. Cost of living and the level of income.

Whatever the purpose, the money saved in financial institutions will be accumulated and loans

will be provided from it to the people who need funds for investment with the intention of

earning an income as interest. This is the major source of financing the investments. In addition,

based on the deposits, commercial banks provide funds by creating credit. Thus, saving increases

the investment and the national output.

Along with the growth of national output, economic growth takes place. Economic growth is the

outcome of industrial development. Industrial development creates more and more employment

opportunities thereby reducing unemployment in the economy. An increase in employment

opportunities increases the income of the people and reduces the government’s welfare

expenditure. Reduction in recurrent expenditure increases the government’s savings too. In

addition, an increase in output increases the demand for other factors of production.

Additional income generated by economic growth gives an impetus to the aggregate demand

in the economy. An increase in aggregate demand exerts a circular effect on national output.

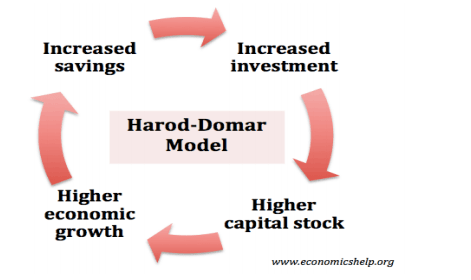

As per the Harrod-Domar model, higher economic growth increases the savings and investment

in the economy. Increased investment improves the capital stock and the national output or economic growth.

Saving is a part of disposable income not spent for consumption. An increase in saving reduces the

demand for goods and services. At a time of inflation, a fall in aggregate demand eases the

pressure on inflation.

Investments

The term “Investment” can be defined as “An increase in the stock of capital in an economy over

a given period of time”. In an economy, both investment and saving are interrelated. The more is

saving the higher will be the investment. The part of income saved either by the individuals

or the government will be used for increasing capital.

It may be in the form of purchasing stocks or bonds, purchasing tools, machinery, or other equipment all that are considered as investments

in an economy. Whatever the form is, the rate of investment is important to the economy because

it brings about the following changes in the economy.

- The occurrence of economic growth due to an increase in the GDP – higher investment

positively affects industrial development which enables the economy to produce more

goods and services. - Increase in income – the demand for factors of production from the producers increases

parallel to the industrial boom. It brings a higher income in the form of wages, salaries, and other factor incomes. - Increase in the living standard of the people – along with the increase in consumer income

and availability of more goods in the economy, the quality and the number of

consumption increases. - Fall in inflation – and increase in output may bring down the price level in the economy.

Saving and investments are the most important factors in macroeconomic development. Against

their benefits, some of the negative effects too can be identified as the cost of saving and

investment.

In order to save, the people have to sacrifice part of their consumption. Even the government has

to cut down some of its welfare expenditure when increasing saving and investing.