The term “Inflation” refers to the continuous increase in the general price level in an economy over a considerable period of time. If the increase in price level is only for a short period of time it is not considered as inflation because it is not harmful to the economy. If the price level increases at a low percentage, it is considered as required inflation because a slight increase in the price level is needed for the dynamic functioning of the economy.

Inflation is measured as the percentage increase in the general price level in an economy between two consecutive years. General Price level or the consumer price index (CPI) is calculated by observing the price changes of a basket of goods that are important in consumer spending. The data is collected in a way that the whole economy is covered.

Causes of Inflation

There are plenty of arguments put forward by different economists at different times. A monetarist, Milton Friedman argues that the major contributory factor that causes inflation is the increase in money supply in the economy. When there is no corresponding increase in aggregate supply, he argues, increases in money supply increases consumer spending and it creates an excess demand for the existing goods and services. As a result the general price level increases.

Keynesians believe that inflation occurs due to the changes in real variables in the economy. They include these factors into two theories;

- Demand pull theory.

The demand-pull theory says that inflation occurs as a result of too much spending in relation to the total output or aggregate supply. The excess demand so created tends the price of existing output up continuously causing inflation.

- Cost-push theory

Keynesians explain that this occurs due to the changes in the supply side of the economy. An increase in the cost of production tends the prices of the product up.

Having considered different arguments, causes of inflation can be identified as below.

- Increase in aggregate demand – Demand-pull inflation.

- Falling aggregate supply – Cost-push inflation

- Imported inflation

Demand pull inflation

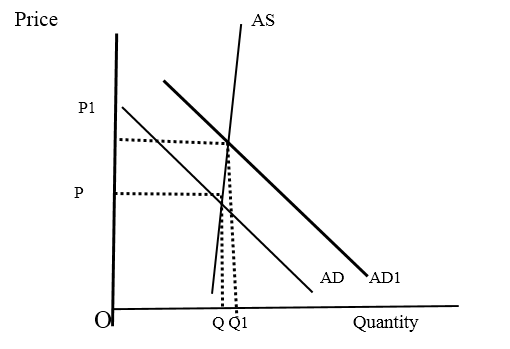

![]() This happens due to the increase in aggregate demand when there is no corresponding increase in aggregate supply. When there is excess demand, the severe competition will be created among the consumers to possess the limited number of goods in the market and it increases the prices.

This happens due to the increase in aggregate demand when there is no corresponding increase in aggregate supply. When there is excess demand, the severe competition will be created among the consumers to possess the limited number of goods in the market and it increases the prices.

As per the above diagram, aggregate demand increases from AD to AD1 but there is no corresponding increase in the aggregate supply in the severe competition created in the economy. As a result, the level in the economy has increased by a considerable amount from “P” to “P1” by creating an inflationary situation.

Causes of demand pull inflation

This occurs due to the increase in consumer spending in the economy. There can be an increase in spending as a result of increase in money supply due to any of the following reasons.

- Financing the govt. budget obtaining credit from the banking sector.

- Reduction in rate of interest.

Increase in govt. recurrent expenditure.

Increase in govt. recurrent expenditure.- Obtaining external credit.

- Expansionary monetary policies of the central bank.

Cost-push inflation

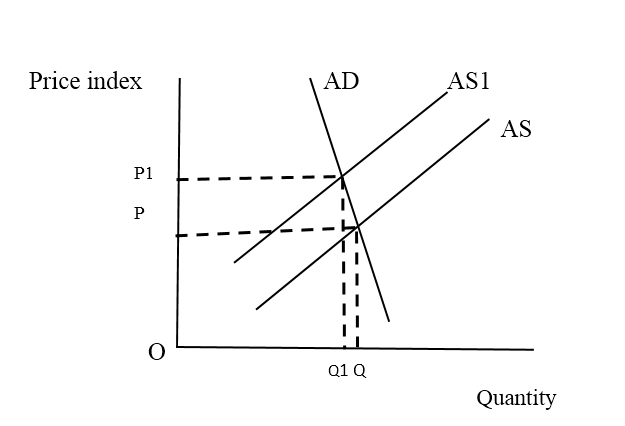

This happens due to the contraction of national output or aggregate supply in the economy. An increase in the cost of production reduces the profit margin of the producers and it will compel them to reduce the supply. Fall in supply creates a shortage of goods in the market and it will tend the prices up.

The above diagram explains that aggregate supply da decreased from “AS” to “AS1” increasing the price level in the economy from “P” to “P1” by a considerable proportion. If this situation continues, there will be an inflationary situation in the economy. The cost of production increases mainly due to the influence of any of the factors.

- Increase in the prices of raw materials.

- Increase in government taxes.

- increase in wage rates

- Reduction in government subsidies.

- increase in wage rates

- Reduction in government subsidies.

Imported inflation

In modern economies, most of the countries depend on international to make their domestic economies stable and import of goods are unavoidable. If the goods are imported from the countries where there is inflation, it will create inflation in the domestic markets too.

Effects of and remedies for inflation

Inflation may affect the different sectors of the economy.

- Fall in the real value of money

- Fall in the consumption and the living standard of the people

- Discourage savings and investment

- Increase in cost of production due to increase in factor prices

- The decrease in aggregate supply

- Higher unemployment

- Discourage lending

In order to minimize the adverse effects of inflation, the governments implement monetary and fiscal policy measures. Monetary measures will be implemented to reduce the money supply in the economy. In addition, fiscal policy measures such as reducing taxes, providing producer subsidies, etc. are implemented to encourage production.