Business cycles can be defined as the regular fluctuations of national output or the aggregate economic activities of an economy. The business cycle affects not only the national output or the GDP but also all the macroeconomic sectors such as level of employment, general price level, sales, and international trade, etc.

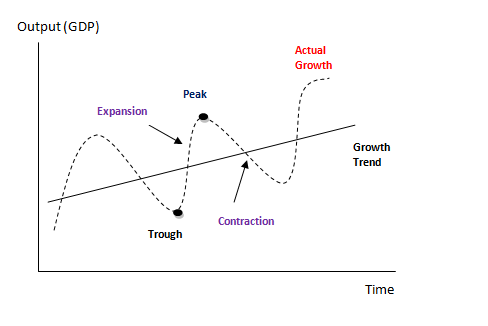

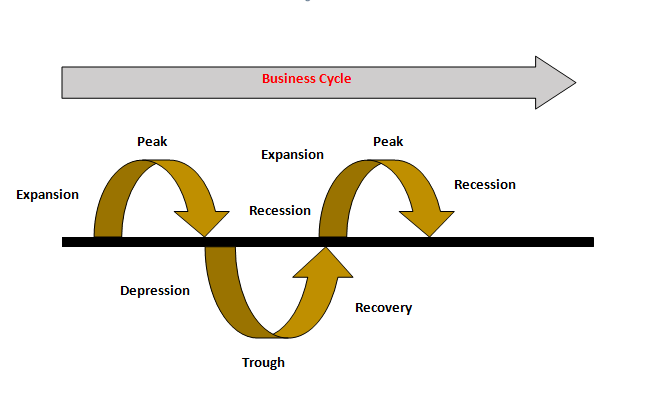

Business cycle consists of different stages as shown the following diagram.

The straight line shows the growth trend in the economy and the dotted lines is to represent the actual growth of the GDP of the economy. In addition, it shows different stages that an economy undergoes when in business cycles.

- Expansion

- Boom/Peak

- Recession

- Depression

- Through/Slump

- Recovery

- Expansion

At this stage, all the macroeconomic indicators such as output, employment, income, investment consumption, etc. increase positively. Investors are confident and the financial sector provides sufficient funds.

- Boom/Peak

When the economy is at the peak stage, the national income is high and the working beyond full employment. Consumption is high because the consumers have restructured their spending. Investment expenditures too are at the maximum. The government’s tax revenue will be high and the wages will be rising and the profits of the industries too will be high. The economy reaches the saturated point and the economic indicators do not grow further. The economy marks the reversal trend of economic growth. Workers are confident enough for demanding higher wages. This situation continues as long as the conditions are favorable for expansion.

- Recession

The recession is the downward trend of the economic indicators such as the GDP, full employment, income, consumption, investment, etc. Since the aggregate demand does not show a sudden decrease, the producers continue the production. As a result, an excess supply created in the market tends the prices of goods and services down. All positive indicators such as income, output wages, etc. start to fall. Unemployment is on the rise. The government’s tax revenue falls but the welfare expenditure increases.

- Depression

The curve that shows the actual growth goes down the growth trend line and reaches the through the state. During this period of time, the GDP continues to decline and there will be a commensurate increase in unemployment. The economy’s growth rate becomes negative.

- Through

The economy is at the bottom of the business cycle. It is a negative saturation point for the economy. Economic activities are at the lowest in comparison with the surrounding years. Mass unemployment exists and most of the people lose their incomes and consumption and the investments are at the lowest. Though there may be a fewer inflationary pressure, the prices may fall due to a fall in aggregate demand.

- Recovery

The recovery occurs when the output increases from through stage or the bottom of the cycle up to the level of the growth trend. There is a turnaround from the through the economy starts recovering from the negative growth rate. Aggregate demand starts to pick up due to the low prices and the supply starts reacting. It provides a positive signal to investment and employment. As a result, the aggregate supply increases.

Diagrammatic explanation shows that the trade cycles are moving around the long-term trend rate of growth of an economy. At the height of the boom, the output is above the long-term growth trend would predict. In the recession, it is below the growth trend rate. This difference is measured as the” output gap”.

Causes for business cycles – (Models)

By considering the causes for the occurrence of business cycles, two models can be identified as below.

- Exogenous Model

These are the business cycles that started due to the shock to the economic system from external reasons. Wars, Revolutions, Discovery of gold mines, large movement of Population, etc. may have either negative or positive effects on macroeconomic factors of the economy. Eg. Fourfold increases in the prices of oil in 1973/74, gave a significant supply-side shock to the world economy.

2. Trade Cycles

Trade Cycles caused due to the effects of internal factors within the economic system. Even though there are no supply-side shocks, the economy may fluctuate over time.

The cost of Trade Cycles

- Loss of income to those who were unemployed during the recession even if the majority of workers were unaffected.

- Fixed income earners would suffer in the boom period due to possible inflation. Their spending power is eroded due to the higher prices of goods and services.

- Due to the loss of human capital the economy may not bounce back after a deep recession. This can happen as a result of early retirement, loss of skills due to a long period of unemployment. There can be permanent loss of physical capital too.

The Trade cycle is a vicious cycle with cascading decline in output, employment, income, and sales that lead to a further drop in national output in the future. This will spread from industry to industry and region to region.

On the flip side, when the recessionary vicious cycle reverses it becomes a vicious cycle with rising output triggering job gains, rising incomes, and sales.