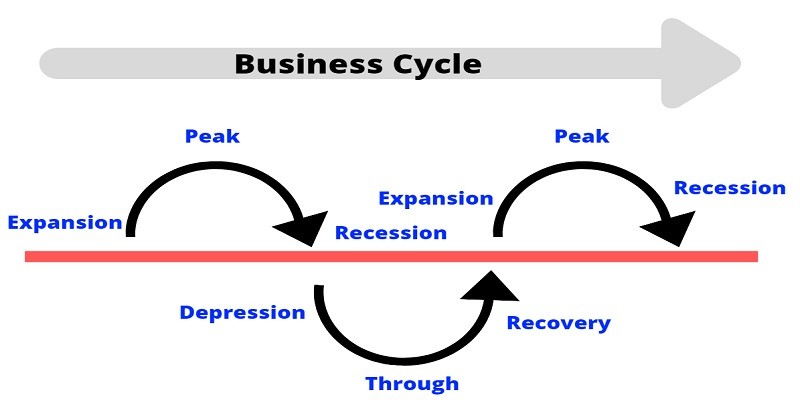

After entering the market, any business has to go through several phases which will increase and decrease the business’s revenue and sales. Business Cycle explains six major phases any usual business would go through. The rise and fall of the product output levels can be identified through the business cycle. This can be identified as the trade cycle or the economic cycle.

Business cycles can be identified as fluctuations in activities happening in the economy within a period. These fluctuations in the economy can be a reason for many sectors such as government, household as well as the output f business entities. The business cycle can be used as an important tool in analyzing economic conditions. Apart from that, it helps the organizations to make better business decisions.

There are six major phases in the business cycle.

- Expansion – This is the first stage of the business cycle. This is the stage when the economy is growing. At this stage, there is an increase in employment opportunities, production outputs, income, and revenue. There can be many investment opportunities that can be seen in the economy and steady money supply.

- Peak – This is the second stage of the business cycle. This is the stage where the economy hits the maximum level of growth. It has reached the maximum price levels, maximum productivity and it stops growing further. The Gross Domestic Production rate of the economy is over 3%. This is a level that many organizations start to restructures there is no more growth in the economy.

- Recession – This is the third stage of the business cycle which the industry will start to move downwards. At this stage, the transition of the businesses reaches a level of contraction. The Gross Domestic Production rate of the economy falls below 2%. The production goes down, unemployment rises due to decreasing production and the sales and the revenue drops due to lack of demand. Mass layoffs happen in the business industry. This will lead to a decrease in income levels as well.

- Depression – At this level, the economy suffers from depression due to the drop in economic growth. The unemployment levels and the reduction in sales and income lead to bankruptcies and adverse credit effects. There can be very less or no investments that can be seen in the economy at this stage as the investors are not motivated to invest in the economy.

- Through – This is the fifth stage of the business cycle where the economy is starting the healing and growth process. At the end of the depression, the economy is starting to grow again and lead to recover the positive conditions.

- Recovery – This is the last stage of the business cycle in which the economy is starting to rise from the adverse conditions. It starts growing again. The prices are starting from low to increase the demand and the employment opportunities are starting to increase and there is an increase in the demand, supply, and revenue. This marks the growth of the economy as well as the end of the business cycle.

The above mentioned 06 stages of the business cycle help the businesses to plan their business activities accordingly and for the economies to stay prepared for the recessions that can happen in the future. This is used as a tool to measure the economic standards ad to predict the future of the economies. Economists use the business cycle often to plan future changes that are necessary for the growth and the survival of the economy. The GDP growth rate is used to measure the business cycle and the changes in the cycle.

Related Articles

Product Life Cycle : 4 main stages